Business in africa

Learn from youth’s street smarts

Informal learning helps mould new leaders.

With Youth Day having been celebrated this week, at a time when the economy is in the state it is, I cannot help but be reminded of the increasing role that today’s young people will play in driving economic growth.

They are the leaders of tomorrow who must be groomed today. They will be responsible for ensuring that our businesses and institutions are led in ways that will help us revive growth and achieve the long-term goals of the country.

They will also need to learn how to become the kind of leaders who understand how to build an economy that creates opportunities for the youth, especially when all the numbers show that Africa will have the world’s biggest and youngest population of working age within a few decades. This is something we need to turn into an advantage, rather than a disadvantage.

We have not yet learnt how to enable our young people to start playing a bigger role in the economy. This is a puzzle that needs to be solved, otherwise we risk losing out on the value they could be adding to the country.

We can start by shifting how we perceive the experience and expertise of our youth. Much of the conversation is focused on how we should be giving people a chance to have even a year of formalised work experience, because this will significantly increase their chances of employability and inclusion in the formal economy.

Let us rather shift the conversation towards what we can learn from them based on their life experiences. Despite not having worked in the formal sector, many inspiring young people have achieved a lot on their own – learning far more than they would have learnt in a formal job.

We need to stop discounting the value of this informal learning – the street smarts you get from having hustled outside the formal work and schooling environment. Our township economy thrives on this. The world’s most respected school dropouts succeeded because they leveraged this informal learning effectively.

There is a ton of learning that takes place in these environments, but it is completely discounted when employees in the formal economy look at the CVs of job hunters.

As someone who has received the best of what the world has to offer in terms of formal higher education and work experience, I cannot help but note that, despite this, half of my expertise to date stems from my experience of having been an informal entrepreneur in my youth, leading projects which, at the time, were critical for survival in a poor community. Today, those experiences help me navigate the most complex of business problems. I use them to upskill those who did not have a chance to gain much informal learning because they grew up with everything formalised around them.

Let us start giving a chance to those who have not had access to formal opportunities but who have learnt much from having spent their lives thriving in informal settings, earning their street smarts.

In our country there are many inspiring young people who have been forced to look after large families long before they became adults.

Someone like that has learnt a lot about responsibility, probably far more than those who have eaten from a silver spoon all their lives.

These informally strong leaders are the kind of people this country needs, especially if we are serious about allowing different points of view to inform how we govern.

The old ways are clearly failing us, and the world is changing faster every day.

Futurists are talking about how we need to start a process of unlearning the old ways, which are no longer relevant in a world that is rapidly transforming.

We need to rewire our brains, and a good start would be to focus on informal learning.

We need those streets smarts to bring in fresh ways of thinking and the boldness that will challenge long-standing systems and processes that no longer work.

It is worth noting that part of the success of the youth of 1976 came from defying what was the norm then; how they thrived by leaning on informal channels of leadership, communication and co-ordination – all this in an environment in which their formal education systems were impaired.

Today we celebrate them.

But how about celebrating the youth of today who are trying to adopt the same mentality in order to succeed?

There are young people out there we need to open our doors for.

We need to do so if we are serious about finding new ways to revive growth.

Passion gives ideas a life of their own

On Sunday last week, I found myself on a panel adjudicating business pitches presented by entrepreneurs from around South Africa.

They entered the Legends in the Making Competition and won the opportunity to attend a weekend entrepreneurship boot camp in Pretoria organised by Somafco Trust, a social enterprise focused on youth development.

I was intrigued to see young people, mostly from underprivileged backgrounds, following their dreams and committing to build businesses. It was truly courageous of them to stand up, speak their minds and receive a barrage of questions from a panel of adjudicators.

Such behaviour puts them leaps and bounds ahead of those who have not even started turning their ideas into reality.

I have been coaching people on effective presentations for many years – anything from personal talks to presentations for the boards of big businesses.

One thing that I have found time and again is that the majority of the preparation time is incorrectly allocated towards the content and technical details of the presentation, and the delivery is overlooked.

This is especially true for entrepreneurs because they are challenged to spend hours and hours preparing the best business case, forgetting that there is more to the pitch than the document itself.

Several studies have shown that the least important part of communication is what you say – that is, the content.

Most of it is driven by numerous nonverbal factors such as tone and body language.

There are three such factors that are critical but quite often missed during pitches: expressing passion for the idea; remaining authentic and being aware of your audience.

Passion is everything. In fact, it is contagious. The more passion an entrepreneur can exhibit for their idea, the more this passion is infused into the audience.

Passion needs to be present all the time, not just when talking to potential investors.

The same is true for conversations with potential customers, suppliers, mentors and even family members who may still have the outdated mindset that going into entrepreneurship is a “crazy idea”.

When I witnessed young people expressing their passions last weekend, I found myself with a growing level of hope that young South Africans have the willpower needed to solve the frustrations that our society has lived with for many generations – frustrations especially detrimental to townships and rural communities. They shared business ideas that could reduce inefficiencies in the public healthcare system, transportation and, most importantly, education.

Passion goes hand in hand with authenticity.

The very word “pitch” misleads us to believe that we should be performing a show of sorts. A plot to hide our true selves for a few minutes. This is a fallacy.

It is more important to present the most authentic version of ourselves. No mask.

When people are deciding whether it is worthwhile to build a long-term business relationship with us, financial or otherwise, they have to see who we really are.

It is not the document or the product they will be investing in. They will be investing in the individual.

Brené Brown is a research professor who is famous for studying vulnerability and authenticity. She delivered one of the most popular TED talks of all time. In her book Daring Greatly, she writes that entrepreneurship is by definition synonymous with vulnerability, and if we shut down vulnerability, we shut down opportunity. She says we need to be able to tell the story of who we are with our whole hearts.

It’s critical to pitch from the heart. This is how we build connections with other human beings.

We need to have the courage to share our true stories, and be vulnerable enough to admit what we do not know.

I have learnt with time how to be authentic and vulnerable when I present to an audience. It can be difficult to expose your true self to others. But these are the moments when I feel most human. They are the moments I feel most connected to my audience.

Pitching is also about listening intently and remaining aware of the audience. Learning about the interests of the audience ahead of time empowers us to communicate in a manner that resonates well with the listener.

Listening gives us the chance to notice what the audience is passionate about and thus connect with them authentically on it.

When someone takes the time to talk to us about our business ideas, it means they want to create a win-win situation for us both.

I am not advocating for people to focus solely on the triad of passion, authenticity and awareness. It goes without saying that it is similarly important to get the basics right about the market, the competitive landscape and how your business will make money.

However, this triad of factors can help entrepreneurs set themselves up for greater success and lasting business relationships.

Angel investors must let start-ups learn from mistakes

The smallest cash infusion can make a big difference

It is puzzling that early-stage investing in new businesses in South Africa is not growing as fast as it should, irrespective of economic factors. It stays low year on year even with initiatives to foster an uptick, from the section 12J venture-capital class introduced by the state, to various “angel investor” networks driven by private investors.

We cannot wholly place the burden on investors – entrepreneurs need to play their part in being investor-ready and having the guts to put themselves out there and find the right financial supporters. This step is difficult for many, especially since being at an early stage might mean you have no clue how to present yourself and your product in an investable way.

Let us also put it down to the low levels of understanding nationwide of what it means to be an investable entrepreneur. Unless you are in a big city, with easy access to the great programmes available, your chances of learning how to be investor-ready are slim.

The factors that limit entrepreneurs are not enough to justify the consistently low levels of early-stage investment and support we see today. Everyone would rather bank on the entrepreneurs who have proved themselves already – much less risky, with a proven stream of revenue. Even then, investors still ask them to put down guarantees and collateral.

For angel investing to work, we need to shift our mentality. This is not the stage at which one needs to think about de-risking – this is about as high-risk a stage as you are going to find. The focus needs to be on the lessons that both the entrepreneur and the early-stage investor stand to learn along the way.

In Silicon Valley, for example, I was struck by how angel investors tended to back the same early-stage entrepreneur over and over again until they found a viable product.

When I asked why, they said the biggest gain was in seeing an entrepreneur learn from failure. You are not investing in the product, you are investing in the lessons that will one day enable that entrepreneur to build a sustainable business. Without trial and error, there is not much that will make that entrepreneur stand out in a sustainable way.

This kind of investment should not be viewed as a series of potential losses but as a series of potential lessons.

The investors also saw it as a dating game, a chance to get to know each other better. Early-stage investing is a multi-year commitment. You stick around until the venture reaches the initial public offering level, at which point you can cash in. This long-term approach to investment makes it clear that it is less about the product or the industry than about the entrepreneur.

I am often asked what industries I focus my own angel investments on and my answer is consistent: I am industry agnostic. I focus more on the person on whom I am making a long-term bet; on helping them figure out how to be most successful.

As the entrepreneur learns, so does the angel investor. You start getting a sense of the character traits to look for in an investee and better understand which ones align with your personality and aspirations.

An angel investor is not something you should be in the distant future when you have finally made it in life. The smallest cash infusion can make a big difference to lives.

I am a proponent of putting your money where your mouth is. It is clear that many mouths in the country see the necessity of increasing early-stage investment support. We need to see more money, however little, channelled in that direction.

Early-stage investing is much riskier than other types of investment but remains one of the only ways we stand to see a game-changing increase in the number of early-stage companies. These will eventually grow into ventures that will change the persistently low levels of entrepreneurship in South Africa.

Out of Africa, always lessons for SA

The many challenges and opportunities that come from doing business in Africa have been studied and documented by international and local stakeholders interested in benefiting from the region’s significant growth opportunities.

I am often puzzled by how some South Africans react when this topic of doing business in Africa comes up. Typically, two groups emerge.

One becomes completely engaged as its members are expanding into the rest of Africa or plan to.

The second group becomes completely disengaged as its members have no plans to “go into Africa” and are often surprised that I give talks to South African business audiences on doing business in Africa, as this apparently would alienate executives and entrepreneurs not interested in expanding into the region.

Both groups are fundamentally flawed in their mindset. All insights on doing business in Africa are based on having reviewed the African region as a whole, South Africa included. So the insights are as relevant to businesses in South Africa as they are to those anywhere else in Africa.

Until the data on Africa excludes South Africa, we cannot afford to discard the insights on the challenges and opportunities of doing business in Africa.

It is no secret that South Africans do not typically see themselves as part of Africa. In everyday conversation, Africa is taken to mean the rest of Africa.

The danger of bringing this mentality into the business context is that it prevents us from proactively learning about challenges and opportunities that come with doing business in a region that we are also a part of.

Indeed, South Africa’s is a far more advanced economy than those in the rest of Africa, and each African country has different merits. But if we start accepting some of the common factors as relevant to us we will soon realise there is much to learn.

For example, one key enabler for doing business successfully in Africa is the ability of your business to become entrenched in local communities. This is true for many emerging markets – the regional differences come out only in terms of the way a business becomes locally entrenched.

In Africa, for example, this means investing in building a local team or finding a local partner. Time and again, multinational companies have failed in Africa because they did not localise their business models.

If South African business leaders realised that this insight was also applicable to their success they would be focusing on localisation, instead of trying to succeed without being entrenched in local communities. We tend to understand the importance of this when we do business in parts of South Africa far from the cities.

Business leaders understand that they need to collaborate with local leaders and involve members of the community in the running of their businesses.

For some reason, we discard this insight in the cities, choosing to lead them in a completely different manner as if our cities are exempt from the way the rest of South Africa or Africa operates.

Another example is the regulatory environment. Regulatory complexity is one of the main challenges in doing business in Africa. This is consistently a barrier for local and foreign businesses and investors. Many African economies are investing in making their regulatory environments less complicated.

Regions such as West and East Africa have made notable strides in the past couple of years, positioning themselves as gateways into Africa, instead of that privilege being held solely by South Africa previously.

According to the World Bank’s Doing Business Report for 2016, South Africa ranked 73 globally, down five places since last year.

In sub-Saharan Africa, this set South Africa back by one spot to fourth place. Other African countries made significant rankings gains, with five of them being in the top 10 improvers globally.

If we do not invest in improving the ease of doing business in South Africa, we face the threat of continuing to deteriorate in global rankings.

It is true that each African economy is unique, but that is no reason not to learn from the insights of doing business in Africa.

Last week, South Africa regained its position as Africa’s biggest economy, a boost for currently low national business confidence.

But we South Africans must set aside our pride and focus on what we can learn about doing business in Africa, South Africa included.

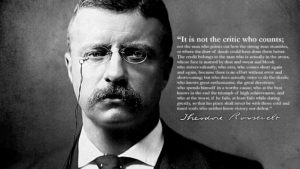

The man in the arena: Be a bold supporter, not a critic

‘It is not the critic who counts; not the man who points out how the strong man stumbles, or where the doer of deeds could have done them better. The credit belongs to the man who is actually in the arena …” These are the unforgettable word

‘It is not the critic who counts; not the man who points out how the strong man stumbles, or where the doer of deeds could have done them better. The credit belongs to the man who is actually in the arena …” These are the unforgettable word

s uttered by US president Theodore Roosevelt in 1910, a little more than a decade after America had emerged as a new world power.

He wanted to emphasise that the success of a country rests on the quality of its leaders and the discipline of its citizens, as opposed to the distracting commentary of others.

There is a reason that his words are still referred to in presidential speeches and literature. Nelson Mandela, whose passing we commemorated this week, gave a copy of Roosevelt’s words to the captain of the South African rugby team, Francois Pienaar, just before the team proceeded to beat the All Blacks in the 1995 Rugby World Cup final. US President Barack Obama referenced Roosevelt’s words this year in a speech he delivered during the run-up to the presidential elections.

Roosevelt’s words are a reminder that the person who deserves our respect, admiration and encouragement is the man in the arena – the person taking notable strides towards making South Africa a better place, and not necessarily the critic commenting from the sidelines.

Despite the tough economic environment, we have seen a number of politicians, business leaders and members of broader society take bold actions that have helped keep our economy stable and retain its investment-grade status. They achieved this despite judgment and criticism. Sometimes their actions were risky and unconventional – they were being the man in the arena – but their quality in character and discipline in action helped them to persevere until the desired outcome was achieved.

There is still a long way to go in the mission to revive growth and restore confidence across the country. We need more people to act as supporters and encouragers, so that more people can feel comfortable with being the bold man in the arena.

As we look to the year ahead, each of us should choose whether we want to be critics or supporters who encourage others to go out and take bold actions. I hope most of us opt for the latter, otherwise we will be remembered as the country that had great potential but struggled to support those who had the willpower to unleash that potential.

The more we can shift towards a more supportive and encouraging society, the more people will feel encouraged to take the big leaps they would otherwise not take.

As an example, one of the key levers for growth in this country is the development of small, micro and medium-sized enterprises. We are in dire need of more citizens to participate in that space, yet too few are bold enough to take the leap towards developing their small businesses. They are hindered by the fear of being judged by the critics should they fail.

Imagine how different the outcome would be if those critics actually turned into the supporters you need to start and develop a solid business – from funders, mentors and customers to suppliers. There would be much more development in this space, and more small businesses would prosper.

The fact that you are not yet ready to start and grow your own business, or lack the desire to do it, does not mean you cannot play a role in supporting those who are ready to do so. We each have the ability to help small businesses in different ways. We have to, given their significance to the development of our country’s economic growth plan.

Roosevelt emphasised that the person he referred to as the man in the arena is someone “who spends himself in a worthy cause; who at the best knows in the end the triumph of high achievement, and who at the worst, if he fails, at least fails while daring greatly”. Our fear of failure tends to drive us away from taking action, but if we focus on daring greatly and taking action despite the fear, we might just find ourselves in a triumph of high achievement.

Leave a Reply